The relation

of total cost to volume of operations has its most important application in

management accounting, but is also used in cost finding. It is important in

management accounting because managers frequently face decisions involving

changes in volume of operations (along with other changes). To determine the

profit impact of a decision, it is necessary to predict the resulting changes

in cost. This requires knowledge of existing cost-volume relations. In cost

finding, a predetermined overhead rate (burden rate) can be calculated only

after the total amount of overhead cost for the year has been predicted. Since

the volume of output is important to the amount of variable costs which should

be expected, it is necessary to know the cost-volume relation in order to

predict the total amount of overhead cost.

The relation

of cost to volume generally falls into two categories, fixed and variable,

explained below. Other possibilities exist, and the most important

one—semivariable costs—will also be discussed.

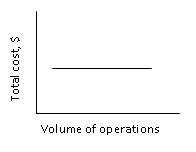

Fixed Costs. A fixed cost is one for which the total

amount of the cost per period is independent of the volume of operations,

within a relevant range of volume. Graphically, it can be shown as indicated in

Fig. A-1. The graph shows that as the volume of operations fluctuates within

the relevant range, as shown

FIG. A-l Graph of a fixed cost.

by the length of the line, the total

amount of this expense, as measured on the vertical scale, remains constant.

Examples include the salary of the factory manager, property taxes, and

insurance on the factory building and equipment. Note that the definition does

not say that a fixed cost will never change. Managers know that salaries,

taxes, and insurance do change. The significant point is that the amount of the

fixed cost is not directly changed by changes in volume. It would be most

unusual, for example, if a factory manager's salary were to fluctuate from

month to month based on the production volume of the factory. (If this were to

happen, the salary would no longer be an example of a fixed expense.) If there

is u significant

expansion of the factory capacity, the factory manager's salary might be

increased at the next salary review. In addition, the expansion of factory

capacity would probably increase the amount of insurance and taxes. However,

these changes would not make these costs variable costs. Rather, the amount of

cost would have changed from one fixed level to another fixed level. The new

line on the graph would be higher than the old line, but it would still be

horizontal. If this were to happen, manage ment would have to replan a variety

of activities anc^ also alter the overhead rate used in the factory.

Variable Costs. A variable cost is one in which the

total amount varies in direct proportion to tht, volume of operations

but the per-unit cost remain constant within a relevant range. This can be illustrated

as shown on the graph in Fig. A-2. To meet this

FIG. A-2 Graph

of a variable cost.

rather strict definition, the line of the

variable cost must be pointed so that it would pass through the origin of the

graph (0,0), if the relevant range extended that far back. A prime example of a

variable cost is direct materials used in the production of a product.

Increasing production by 10 percent will increase the amount of direct

materials used by 10 percent. Further, one should expect that a reduction in

volume of operations by, say, 15 percent, would reduce the amount of direct

materials required by 15 percent. This is because the amount of direct

materials used per unit of product is constant.

The idea of

a relevant range is important because experience shows that if a manager were

to consider doubling volume or cutting volume by two-thirds, cost levels would

change in an erratic manner. But such large changes are the exceptions; dealing

with them requires a special study. In the normal situation, managers have

found that cost can be expected to fluctuate in a predictable manner within the

relevant range in which most decisions are made.

Semivariable Costs. If a cost increases as a result of

volume changes, it cannot, by definition, be a fixed cost. But there are costs

which increase as a result of volume changes but do not fit the rather strict

definition of variable cost. Maintenance and electricity costs are examples.

These costs often fall into the category of semivariable costs. Within the

relevant range, a semivariable cost will increase as a result of changes in the

volume of operations but not in direct proportion to volume. A graph of a

semivariable cost is shown in Fig. A-3. Note that the line

FIG. A-3 Graph of a

semivariable cost.

slopes upward as volume increases but that

it would not pass through the origin if the relevant range extended back that

far.

Semivariable

costs present no new problems in analysis, however, because they can be broken

into a fixed component and a variable component. This can probably be seen most

easily by referring to the graph in Fig. A-4. The graph is the same as that in

Fig. A-3

FIG. A-4 Graph of a semivariable cost showing

fixed and variable components

except that the dashed line is added to

illustrate that the semivariable cost can be thought of as a variable cost with

a fixed amount added on top. The dashed line shows the variable-cost component.

The amount added on top is a fixed amount, the same at all volumes, thus

fitting the definition of a fixed cost. For analysis, a semivariable expense is

broken into its fixed and variable components.

Considering

the examples of maintenance and electricity, one can understand why a fixed and

variable component would exist. The routine preventive maintenance is the

fixed component. The balance of the maintenance could be expected to increase

or decrease as the volume of operations resulted in greater or less use of the

machines. Electricity used ini lighting is likely to be a fixed cost. The

plant must be- lighted whether it operates at 70 percent capacity or 80 percent

capacity; the lighting cost does not vary with volume. The electricity used to

power the machines, however, could be expected to increase or decrease as the

volume of operations resulted in greater or less use of the machines. Thus, the

total elewrmcity cnat would have a fixed and a variable component; therefore it

would be a semivariable cost.